As a continued theme in this blog, an important question to ask yourself in today’s market environment is – do you know what you own? Over the last several years, investors have been moving more money from actively managed mutual funds into index funds with the understanding that having a diversified portfolio of securities with low expenses could minimize overall risk.

But often, investors can find themselves surprised by what they actually own and how it performs over time. While seemingly simple in concept, many index funds come with nuances that really could present a danger to an investment portfolio.

What Is An Index

Simply stated, an index is meant to be a measuring stick. An index is a securities basket representing a whole market or a submarket. It tracks the performance of this market and serves as a benchmark for investors or fund managers. Indexes commonly provide a target to measure performance against.

The S&P 500 Index is arguably the most well-known worldwide. It is based on the market cap of the 500 largest companies in the U.S.

Today, according to the Index Industry Association, there are now more than 3.7 million indexes.

The first index published by Charles Dow (cofounder of Dow Jones & Co.), consisted of 11 stocks – nine of which were railroad companies in 1884. Dow’s first index ended up being a flop. However, in 1896, Dow’s next index was a big hit – The Dow Jones Industrial Average.

Concerns?

Indexing has changed a great deal over the last 135 years. And, while they may be promoted as a more conservative or even a “safer” equity investment with broad diversification, the reality is sometimes very different.

Any firm that devises the indexes face little regulatory scrutiny and can face significant conflicts of interest which have the potential of harming you, the investor. The Wall Street Journal reported that the index provider MSCI relented to a foreign government in Asia to get their companies listed on the MSCI Emerging Market Index. Another incident involving the Libor scandal provides additional evidence showing manipulation of the index.

That said, the most meaningful development in the history of indexes has been index investing. Indexes not only measure but they are used to provide targets to measure the performance of a manager or a mutual fund. Vanguard founder Jack Bogle’s created the first index mutual fund. Index funds represented in many cases a passive portfolio of securities that could include a much lower expense ratio than actively managed mutual funds.

There are various methods used to calculate the value of an index. As an example, some indexes use an equally-weighted index in which all of the securities in the index are weighted in equal amounts.

Another method is a market-capitalization weighted index (“cap-weighted”). This option weights the securities in the index by market value as measured by capitalization (market value x the number of shares). In a cap-weighted index, changes in the market value of larger securities move the index’s overall trajectory more than those of smaller ones. Stocks in the index that are higher priced can have a bigger impact in overall performance of the index because they are weighted heavier than other stocks at a lower value.

How does your dollar get invested into the S&P 500 Index?

It sounds like a simple question. When you invest your first dollar into the S&P 500 Index, it gets split up over the 500 holdings. However, since the S&P 500 Index is cap-weighted, your dollar doesn’t get split up evenly. That is an important point to understand when investing into this type of index.

As stated above, higher priced securities tend to make up a higher weighting in the overall index. The advantage of cap-weighted index is that it reflects the way markets actually behave. Larger companies do in fact have more dramatic effects on the overall market than smaller companies.

Where is the concern?

As of today, several different valuation measurements show that the S&P 500 Index is overvalued – ranging from 30% up to 80% depending which valuation method is used. Some of this high valuation is coming from stocks such as Amazon, Facebook, Google… etc. which, as you well know, have skyrocketed in price over the last several years. It goes without saying that the internet and related social media platforms are very popular right now and for many, they represent a way of life in communicating and relating to people around the world.

As simple as these concepts sound, the original question is still worth asking – do you really know what you own?

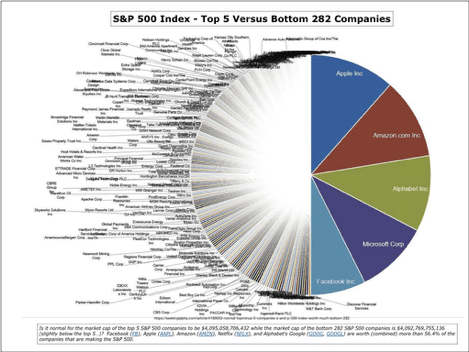

With the cap-weighting used in the S&P 500 Index, your investment looks far less like the perceived broadly diversified portfolio over 500 different companies. In reality, the allocation is not nearly as diversified as many may think.

In 2018, the five largest S&P 500 stocks in the index had a market capitalization equal to the bottom 282 S&P 500 stocks.

The highest sector weighting in the overall index is Information Technology (22% of the overall index). These top 5 holdings all represent internet related & social media technology stocks.

So, in essence, an investment into this index fund is an investment heavily weighted in overvalued social media stocks. And, even though not every individual stock in this index is overvalued, the S&P 500 Index mutual fund that you may be be invested in are represented by these characteristics.

As it turns out, this is a far cry from a broadly diversified, conservative equity investment that many investors view it as. For some investors, this is not the type of risk that they want to take on now.

So, again, even with a simple index fund investment, it is important as an investor to know what you own.