The Double-Whammy Decade

A bond is an investment in which an issuer (an entity borrowing money) pays regular interest payments to an investor (a person or entity lending the money). The arrangement is completed in the future when the issuer pays back the original principal (borrowed money) to the investor. In this arrangement, the interest paid is the primary form of return to the investor. If interest rates at the time of investment are low, the investor expects to make relatively small returns on their money. After purchase, if interest rates rise, then the relative worth of that bond investment decreases because other investors have the choice of buying bonds at those higher interest rates (bond prices move in the opposite direction of interest rates). For more than a decade, bond investors have had the double-whammy of a low interest rate environment and the fear of rising rates.

The Market Often Stretches for Higher Interest

During a period like we are going through where interest rates are very low, it can be tempting to break from one’s investing discipline. Many investors go into riskier bonds (called high yield bonds) to earn higher rates of interest. Yet, we know clearly from history that higher risk bonds suffer tremendously during periods of economic stress. In effect, many investors naturally want the higher interest rates but foolish disregard the risk they are taking.

In general, we have found it beneficial when investing to calibrate our emotions to the opposite of what “the market” is feeling. So when investors, in general, are gleeful and plowing into certain investments, we simply ignore these movements and walk calmly in the opposite direction. In fact, that is what happened in 2019 and early 2020. Many investors bought up riskier high yield bonds even when interest rates on those bonds were clearly not compensating investors sufficiently for the risk of disruption and default. Meanwhile, we decreased our clients’ exposure to riskier bonds.

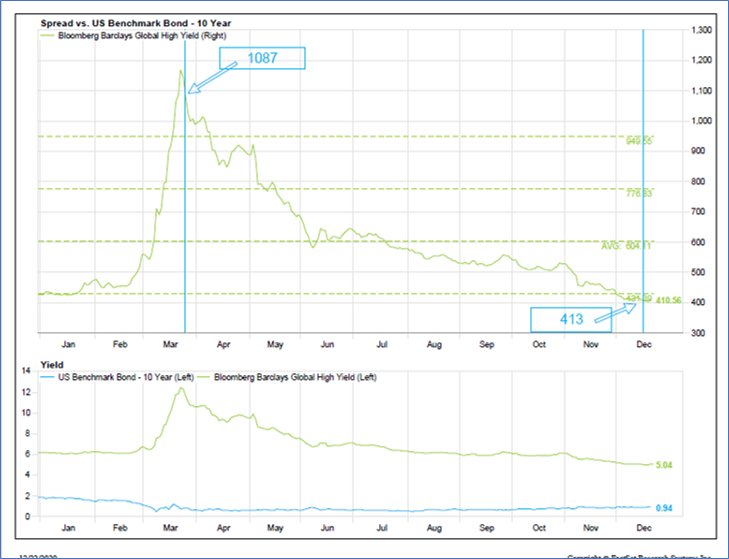

You can see from the chart below, that relative interest rates on high yield bonds earlier in the year were very low. But when the coronavirus hit, interest rates began skyrocketing, pushing the prices of these high yield bonds down dramatically (once again, bond prices move in the opposite direction of interest rates).

Making Lemon Out of Lemonade

The way to make money on bonds is two-fold—simply accept the rates you are given in a particular season of life. Don’t stretch for higher yields until and unless you are adequately compensated for the risk. That is exactly what we did in late March. We bought a very large position on behalf of our clients—about $4 Million—in high yield bonds when the interest rate spread (the relative level of rates) was at it’s second highest point in 15 years. This is shown as 1087 on the chart. We knew at that time we could happily own high yield bonds because the reward for owning them (which was an interest rate of over 10%) more than compensated for the risk.

We expected the relative interest rates to fall over time as the economy and the bond market normalized, but we have to admit we were surprised at how swiftly the bond market recovered. You can see from the chart that the relative interest rates on high yield bonds collapsed back down to their pre-coronavirus levels. This is shown as 413 on the chart. Once again, because bond prices move in the opposite direction of interest rates, our clients made over 25% return on high yield bond investments in about 9 months.

We’ve Been Here Before

We feel the same way now as we did earlier this year—high yield bond investors have plowed into these riskier bonds and are once again not being compensated adequately for the risk they are taking. I believe it was Yogi Berra who said, “it’s déjà vu all over again.”

As a result, we find ourselves in the position of selling a large portion of our high yields bonds. Now is the time to sell riskier high yield bonds and reinvest into safer, more conservative bonds (particularly those with shorter maturities). This means that in the coming months (or even years), investors could earn a relatively low rate of interest on these bond investments. However, we commend patience and prudence to pie-in-the-sky optimism and foolishness.